Some Known Details About Custom Private Equity Asset Managers

Wiki Article

The Ultimate Guide To Custom Private Equity Asset Managers

(PE): investing in companies that are not openly traded. About $11 (https://cpequityamtx.carrd.co/). There may be a few things you don't recognize concerning the industry.

Personal equity companies have a variety of investment choices.

Due to the fact that the most effective gravitate towards the larger offers, the middle market is a dramatically underserved market. There are extra vendors than there are highly experienced and well-positioned finance professionals with comprehensive buyer networks and sources to take care of an offer. The returns of private equity are usually seen after a few years.

Our Custom Private Equity Asset Managers Ideas

Flying below the radar of large international firms, a lot of these little firms typically give higher-quality customer solution and/or particular niche product or services that are not being provided by the huge empires (https://www.intensedebate.com/people/cpequityamtx). Such advantages draw in the rate of interest of private equity companies, as they possess the understandings and savvy to exploit such possibilities and take the business to the next degree

Personal equity investors have to have dependable, qualified, and trustworthy management in position. A lot of managers at profile business are offered equity and benefit compensation frameworks that reward them for striking their economic targets. Such alignment of objectives is normally needed prior to an offer gets done. Private equity possibilities are commonly out of reach for individuals who can not spend countless bucks, but they should not be.

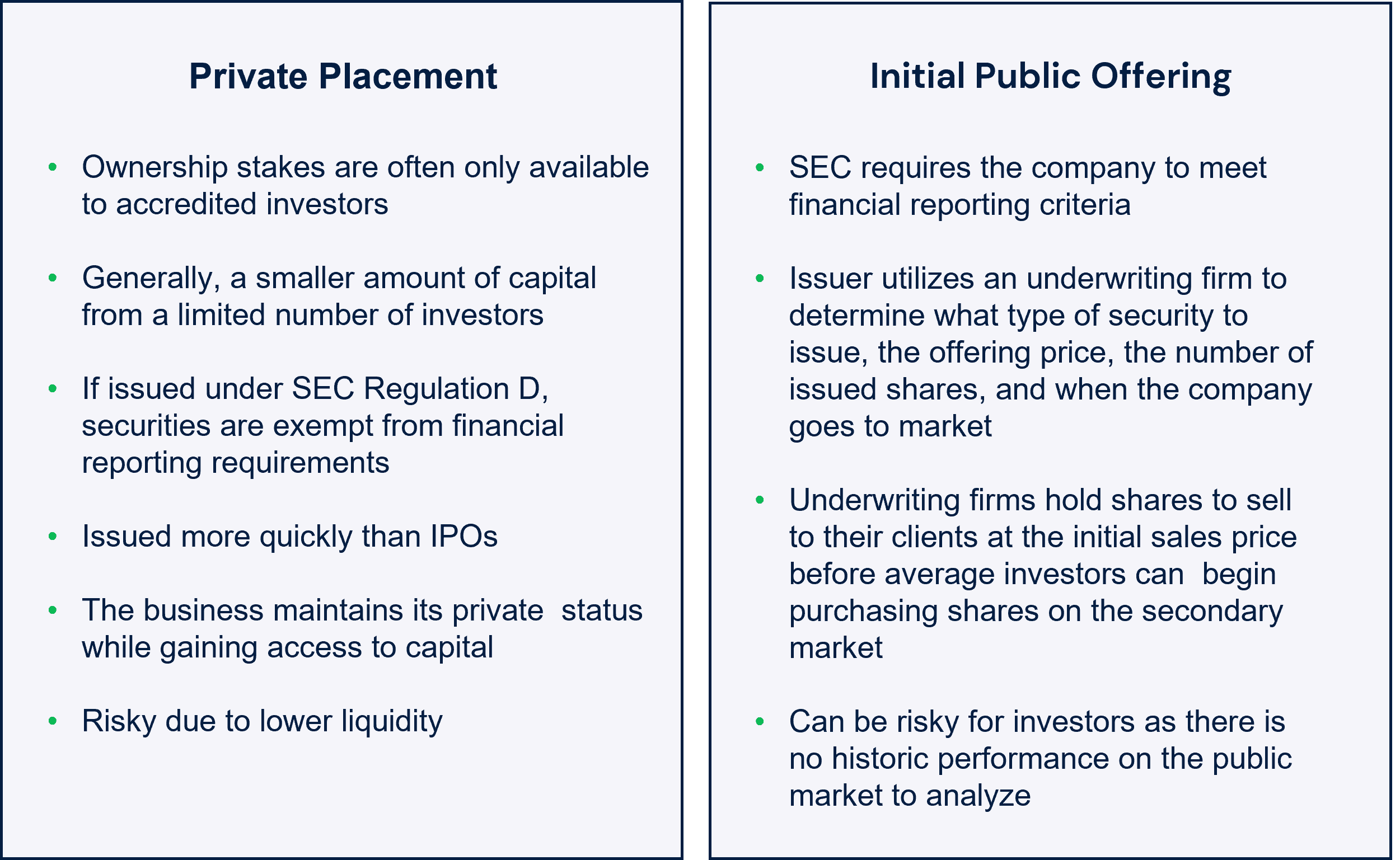

There are laws, such as restrictions on the accumulation quantity of cash and on the number of non-accredited financiers. The private equity service brings in some of the very best and brightest in company America, consisting navigate to this site of top performers from Fortune 500 firms and elite management consulting firms. Regulation firms can additionally be recruiting premises for personal equity works with, as bookkeeping and legal abilities are required to total offers, and transactions are extremely demanded. https://giphy.com/channel/cpequityamtx.

Not known Factual Statements About Custom Private Equity Asset Managers

One more disadvantage is the absence of liquidity; once in an exclusive equity transaction, it is not easy to get out of or market. With funds under administration currently in the trillions, exclusive equity firms have actually come to be eye-catching investment lorries for rich people and organizations.

For decades, the features of exclusive equity have made the possession class an eye-catching recommendation for those that might participate. Since accessibility to exclusive equity is opening as much as more specific investors, the untapped capacity is coming true. So the question to think about is: why should you spend? We'll start with the main debates for spending in private equity: Just how and why personal equity returns have actually historically been greater than various other assets on a number of levels, Exactly how consisting of exclusive equity in a profile influences the risk-return account, by helping to diversify versus market and intermittent risk, Then, we will certainly detail some vital considerations and risks for personal equity financiers.

When it pertains to presenting a new possession into a portfolio, one of the most fundamental consideration is the risk-return account of that property. Historically, personal equity has actually displayed returns similar to that of Arising Market Equities and greater than all various other standard possession classes. Its relatively low volatility combined with its high returns makes for an engaging risk-return account.

Some Known Incorrect Statements About Custom Private Equity Asset Managers

Personal equity fund quartiles have the widest array of returns across all different property classes - as you can see listed below. Technique: Inner rate of return (IRR) spreads out computed for funds within classic years individually and afterwards balanced out. Average IRR was calculated bytaking the average of the mean IRR for funds within each vintage year.

The impact of including private equity into a portfolio is - as constantly - reliant on the profile itself. A Pantheon study from 2015 recommended that including exclusive equity in a profile of pure public equity can unlock 3.

On the other hand, the very best private equity firms have accessibility to an even larger pool of unidentified chances that do not deal with the exact same scrutiny, as well as the resources to do due diligence on them and recognize which are worth purchasing (Private Investment Opportunities). Investing at the first stage indicates greater danger, but also for the firms that do prosper, the fund advantages from greater returns

7 Easy Facts About Custom Private Equity Asset Managers Shown

Both public and private equity fund managers commit to investing a portion of the fund but there remains a well-trodden concern with lining up rate of interests for public equity fund administration: the 'principal-agent trouble'. When an investor (the 'major') hires a public fund manager to take control of their capital (as an 'representative') they pass on control to the supervisor while maintaining possession of the properties.

In the situation of exclusive equity, the General Partner does not just gain a monitoring charge. Personal equity funds likewise mitigate another kind of principal-agent trouble.

A public equity financier eventually wants something - for the monitoring to enhance the stock rate and/or pay rewards. The investor has little to no control over the decision. We revealed over the number of private equity strategies - particularly majority acquistions - take control of the running of the company, guaranteeing that the long-lasting worth of the company comes first, pushing up the roi over the life of the fund.

Report this wiki page